Understanding TDS

MARCH 2023

In Simple Words

According to Indian Income Tax rules - TDS must be withheld if rent from a single source surpasses ₹ 2.4L in a fiscal year.

Therefore, within these guidelines, an investor may allocate an amount which generates a rental income below ₹ 2.4L without TDS liability.

Some individuals with numerous investments might surpass this threshold in the approaching financial year and these users should receive prior notification.

Impact

It will be within ITR Compliance, preventing any TDS-associated fines for Business and Users Will gain confidence in making sizable investments Reduction in support ticket inquiries related to TDS

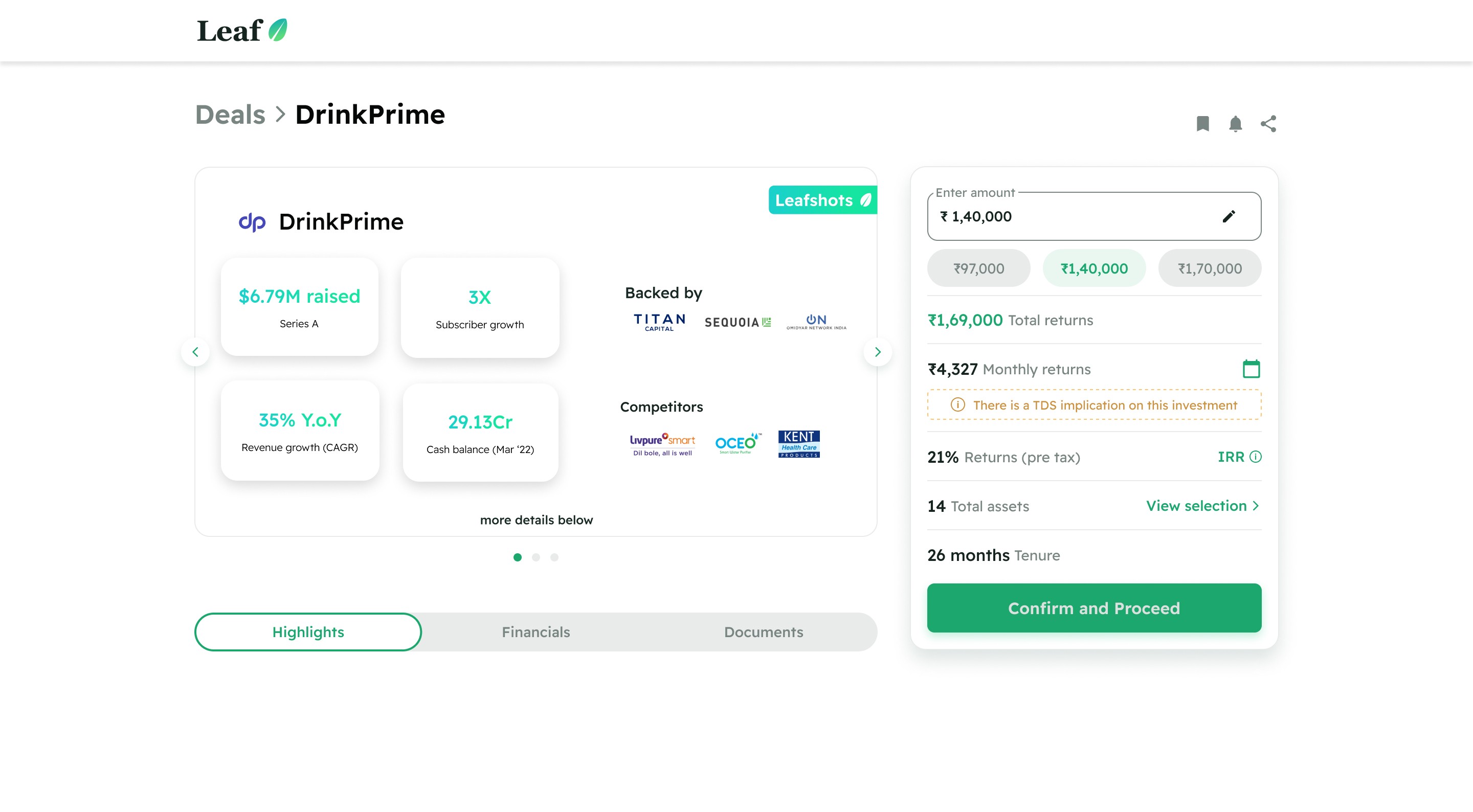

Adding a Clear message to show the TDS implication on the First Investment

TDS message Banner

The TDS alert banner displayed a subtle warning signal, informing the user of potential TDS implication on their investment. By clicking the message, the Payout Schedule would appear, clearly indicating the deducted TDS amounts from the monthly rental.

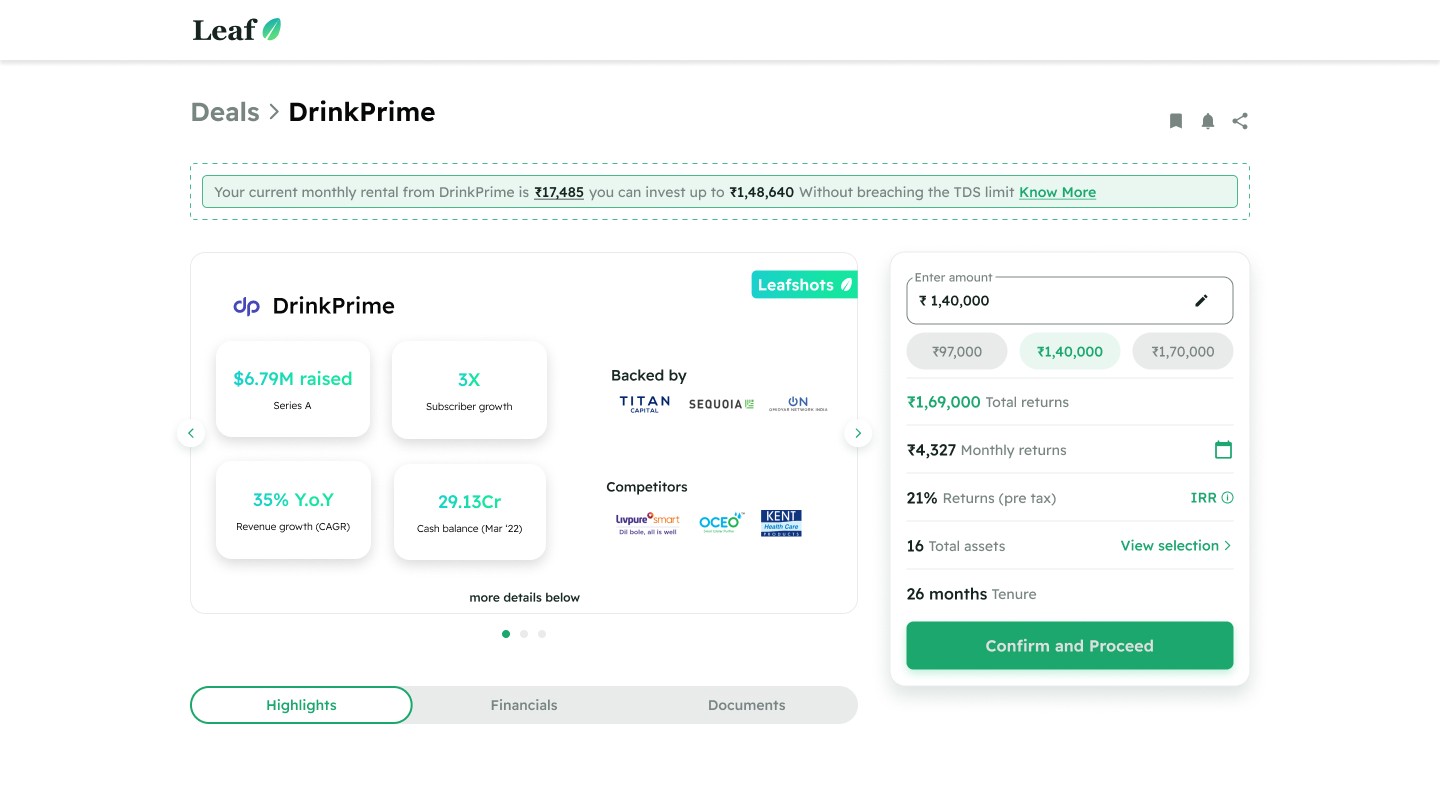

Adding Floating banners to bring awareness to the user on Repeat Investments

Floating Banner

The rationale for utilizing a floating banner rather than a fixed primary header is that each instance has varying significance on the user's investment, the banner should appear as part of the deal page, not the entire platform.

Adding more relevant information to the FY returns

Adding FY Returns

By incorporating FY returns into the Payout Schedule, users will gain a comprehensive understanding of FY returns surpassing the TDS threshold of ₹2.4L within a specific FY. This will also display the total rent the user earns from a lessee.

V3, Designed and Developed on framer

© 2024 itsonlyanoop.com. All rights reserved.